Call Today

1.416.860.9797

Grow your wealth via

Investing That Empowers You

Download Our E-BookBenefit from our Core – Satellite Approach

Call Today

Grow your wealth via

Benefit from our Core – Satellite Approach

ANTYA Investments Inc. (“ANTYA”) offers discretionary investment management services through Separately Managed Accounts (“SMA”) to Canadian investors in Ontario, British Columbia and Alberta. Our mission is to provide customised, focussed and disciplined wealth management. ANTYA believes in low-volatility investing. We intend to preserve and enhance capital, provide diversified market exposure and minimise volatility of returns by following a Core-Satellite approach to investing.

Read MoreOur portfolio management service is designed to provide institutional grade investment advice to Canadians in a simple and transparent manner with easy to understand pricing. Our Core-Satellite approach is a proven methodology to accumulate wealth over time.

ANTYA also provides portfolio review services on a fixed-fee basis to investors in Ontario, British Columbia and Alberta. Our portfolio review service is designed to inform investors on the suitability, diversification benefits and overall costs of their current investment plan.

ANTYA’s views on investing, economy, markets and more are published regularly. VITARKA, our monthly research publication presents our opinion on an important topic relevant to ANTYA’s investors and Canadians in general. We also publish less comprehensive but more topical commentary.

ANTYA Sleep Easy - Income Portfolio

ANTYA Sleep Easy - Income Portfolio

ANTYA Pivot - The Balanced Portfolio

ANTYA Pivot - The Balanced Portfolio

ANTYA 20/20 - The Growth Portfolio

ANTYA 20/20 - The Growth Portfolio

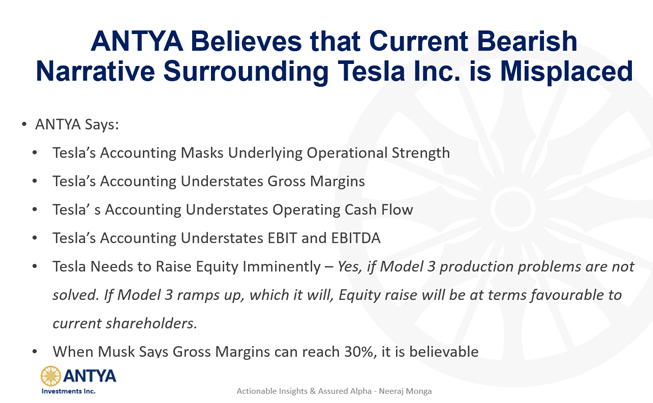

The noise surrounding Tesla Inc. and its prospects has reached a crescendo and will die down with the successful execution of its business plan. It reminds us of the “Fake News” term coined by President Trump. Investors need to turn-off the business news channels, ignore the clamour and devote time to more fruitful pursuits. The economy and most corporations are in good shape.

Read more

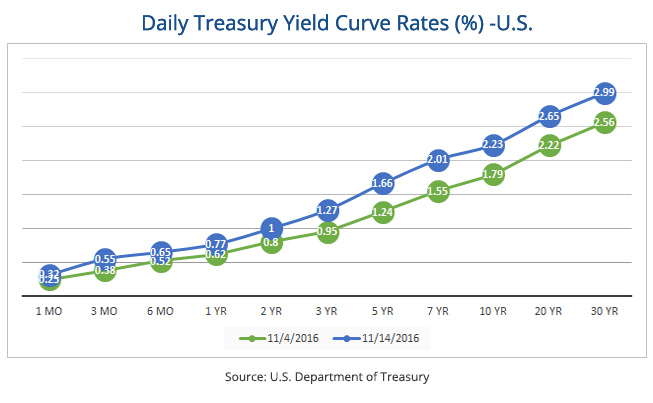

An audacious President-elect has done what the collective might of central bankers from G-7 couldn't do. ANTYA highlights eight things to watch out for in 2017. Our view is that the S&P/TSX Composite will struggle in 2017.

Read more

The founder of ANTYA, Neeraj Monga, was previously a significant shareholder, board-member and Head of Research at one of Canada’s leading independent equity research providers.

Read More

Daniela Liscio is Of Counsel, acting on a variety of corporate and commercial matters for Kent T Perry & Co, a Kansas City law firm.

Read More

Mrs. Li has 20 years of proven success in financial and business analytics, strategic planning, performance measurement and execution of strategic large scale and complex initiatives..

Read More

Tauseef has close to 17 years of international experience in managing financial and strategic investments for global corporations in North America.

Read More

Robust Risk Profile Tool Used in 11 countries

Approximately

million risk assessments globaly

Experienced team with a cumulative experience of

years

Makes for Canada's Number 1 Portfolio Management Platform

Canada’s Largest Independent Fund Company.